Welcome to my series of video tutorials on how to prepare Form 990-EZ information return for small tax-exempt organizations. I'm David McCree, a CPA, and you can find me on the web at my Form 990-EZ Comm. Part 4 of the Form 990-EZ is probably one of the most problematic sections on the return. Understandably, people don't like listing their name and compensation on a public document. If you're an officer, director, trustee, or key employee, you must disclose your information in Part 4. Here, you will find Part 4 of Page 2 of the Form 990-EZ, which includes the list of officers, directors, trustees, and key employees, along with their compensation. The example provided is a typical Part 4 for an average charitable organization. In Column A, the officers are required to put their name and their title. In the case of this example, it includes a president and a vice-president. The directors, on the other hand, are simply listed as directors without specifying their names. In previous years, the IRS asked for addresses to be listed, but the current Form 990-EZ does not require it, and you should not provide an address. The information required for disclosure in Part 4 includes the name, title, average hours worked per week, and amounts of compensation paid. Schedule O can be utilized to explain any compensation arrangements in greater detail. I highly encourage the use of Schedule O if the arrangements are not straightforward. It is commonly observed in small organizations that the executive director, who may also be a founder, chooses not to be listed in Part 4 to avoid disclosing their compensation. However, this is not acceptable to the IRS. Failure to disclose the required information can result in the return being deemed incomplete and, therefore, not filed. This...

Award-winning PDF software

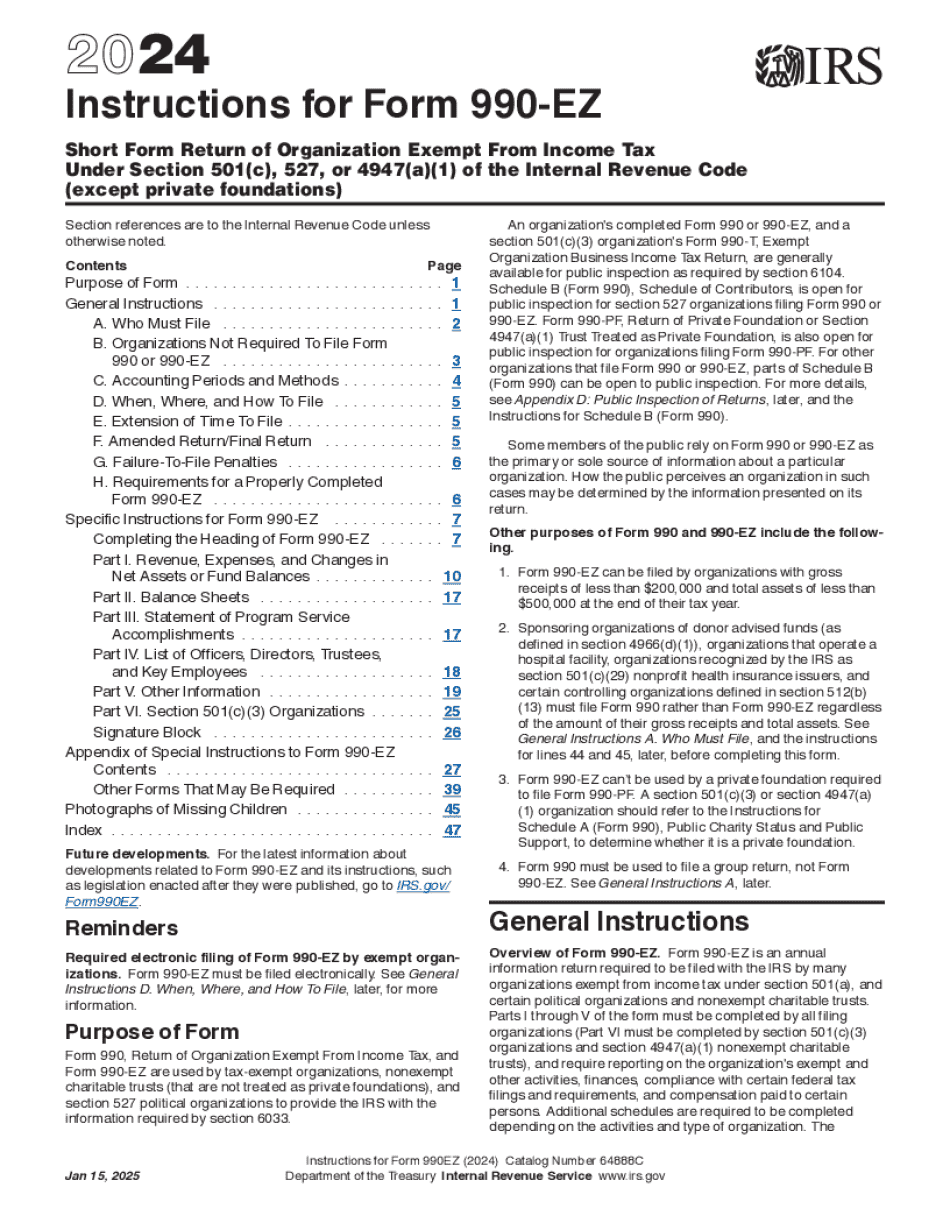

instructions 990-EZ Form: What You Should Know

For the 2025 and 2025 tax years, and <500,000 for the 2025 tax year. You cannot use the form to report noncash gifts. Also see instructions below for completing Form 1040.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 990-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 990-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 990-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 990-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form instructions 990-EZ