Award-winning PDF software

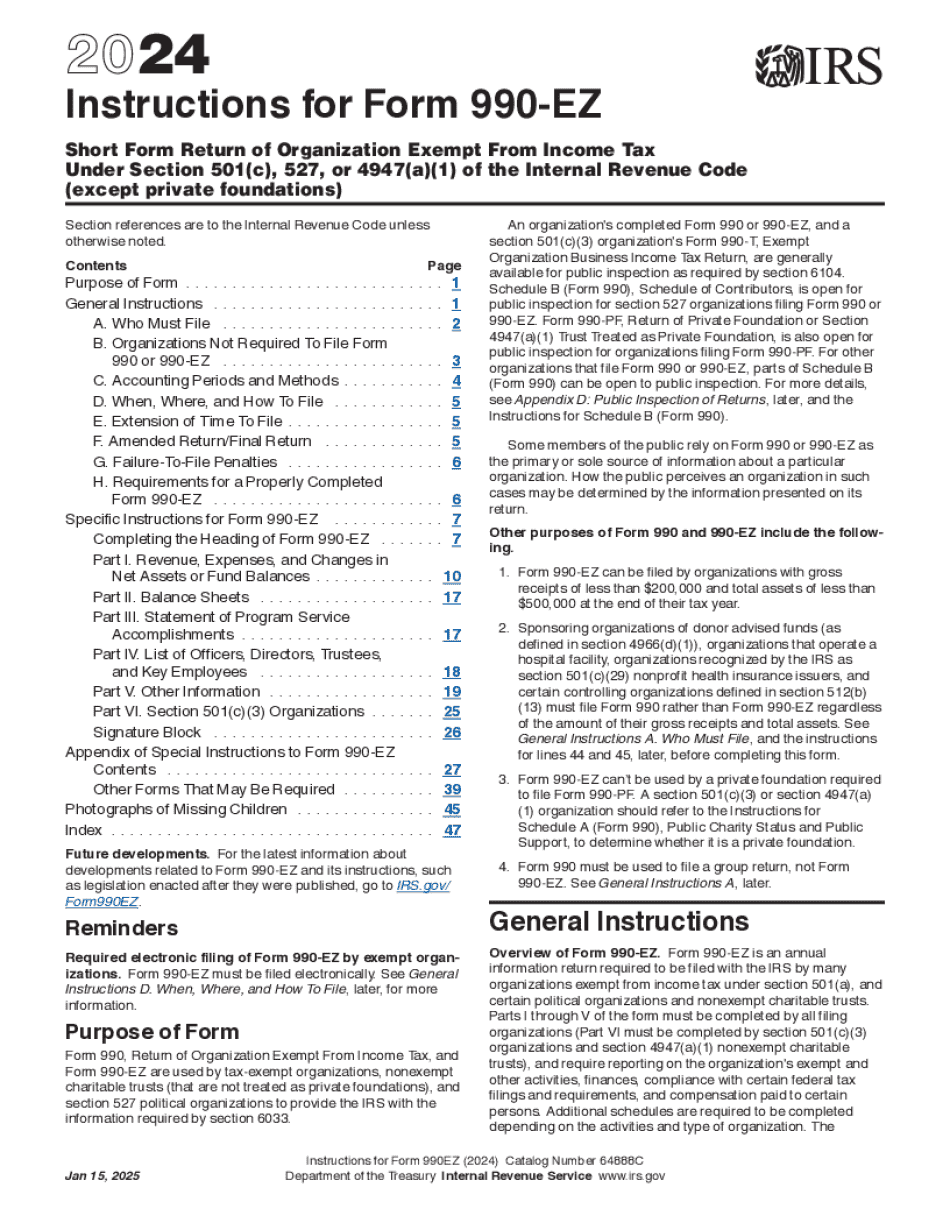

instructions for form 990-ez - internal revenue service

Org(a) organizations. It includes a form part that is designed to catch up on any income made off your self-employment. If you are considering self-employment but have not registered, this is for you! The 990-EZ is a 10-year financial breakdown of your business. It breaks down business activities, revenues, expenses, and other financial transactions for the year in question. It's a good way to see how a business is doing. You'll get an idea of how the business is doing. It can give you a sense of your business and its current operating costs. The IRS requires the 990-EZ to contain the following information: Total amount of gross receipts reported The total amount of gross receipts used for business The total amount of gross receipts used for personal expenses for the year The total income from self-employment and any additions to income for tax purposes Total expenses for business of self, personal,.

About form 990-ez, short form return of organization exempt from

How to Correct a Report If the information you received does not match the information listed above, you can change your form or correction information, and send the corrected form or corrections to the address below. Please follow any instructions you receive from the IRS.

instructions for form 990-n and 990-ez - amazon s3

The return can be filed electronically on the nonprofit's website, and you can download and use it if you qualify. Here are some additional questions and answers for preparing the IRS Form 990-EZ. Can I use IRS Online or E-file to prepare my return or if I need help? You can prepare your return using IRS Online, or you can complete the Form 990-EZ by using IRS E-file. Here are some more answers to some common questions about IRS software. Where can I find the IRS Forms 990? You can find the IRS Forms 990 at the following IRS Taxpayer and Government Entities website: Online: By Mail: online: Do I have to report the donation to my organization so that it can be taxed? Organizations may use the non-taxable contribution to Form 990-B in lieu of making its own Form 990-N. It does not matter if the non-taxable contribution is reported to the organization at.

instructions for form 990-ez - utah pta

EZ as issued by the IRS. However, they are helpful to both taxpayers and the IRS. In order to assist in our ability to fulfill our obligations in the law and the IRS regulations, we will provide a Tax Loss Example for the Tax Code. There are two main purposes for using this example. First, it can give taxpayers something for their tax preparer to work with: In this example you report 50,000 of taxable income for which no deduction was claimed on Form 990-EZ. Your itemized deduction is 8,000 (of 50,000 = 5,500), leaving you with 35,000 in taxable income as reported by you on Form 990-EZ. (Note that itemized deductions can be claimed on a timely filed return, but for general purpose taxpayers, if you need this information you may wish to look through your existing returns, and use an experienced tax attorney to help with those returns that.

form 990-ez instructions - expresstaxexempt

Complete this form to report a change in the organization's information since filing Form 990. Form 990-EZ details are available online at and by using the IRS Form 990-EZ form available in a new window or by using Form 990-INT-EZ details. If you filed your last Form 990-EZ by mail and would like to have your Form 990-EZ details online, follow these instructions: Step 1: Log into your personal IRS account and go to My Account. . Fill in Form 990-EZ details, providing the relevant information from Step 2, above. Form 990-EZ details are available online at and by using the IRS Form 990-EZ form available in a new window or by using Form 990-INT-EZ details.