Award-winning PDF software

Beaumont Texas Form Instructions 990-EZ: What You Should Know

The IRS can audit The IRS can audit your organization if you fall within the scope of the federal income taxes that apply to your organization. We may audit an organization if it knowingly fails to meet the tax obligations imposed under the Internal Revenue Code (IRC). IRS auditing means it can conduct an examination of the organization's books and records, including any returns. The audited entity (or partnership if you are an LLC or a trust) should provide all necessary information, so the audit can be coordinated and conducted effectively with other tax authorities or the government agency that administers the IRS. How auditing works An audit is an examination of records and evidence in order to determine the organization's tax-exempt status and the organization's federal and state tax liabilities. The IRS has established an independent administrative office — called the Taxpayer Advocate — that acts as a special advocate for taxpayers of all income levels. The IRS has a statutory right to audit a tax-exempt organization if it believes that an organization is acting in an unfair or fraudulent manner. To determine its reason for audit, the IRS must have: reason to believe the organization's financial statements or records do not fairly represent the organization's financial condition and operations; The organization must provide information required by law or regulation; The organization is engaged in a pattern of misconduct; This pattern of misconduct results, or threatens to result, in tax penalties, significant adverse publicity, or substantial loss of public confidence in the IRS. For information about IRM 21.16.9, What constitutes reasonable cause, see IRM 21.16.7, Reasons for a Report to Internal Revenue Service: Audit How to audit For paper filing, if you use the electronic tax filing system, use the following procedures to initiate an audit. For paper filing, if you use the electronic tax filing system, if you send Form 990-T, Line 23 or Form 990-EZ, Line 29, and if you receive an audit letter or letter of request, follow the instructions of that request letter. (see below). If you do not receive a letter or letter of request, you must send the following information by U.S. mail. Send the IRS a letter that addresses the following: The IRS request letter that indicates that the IRS received your organization's IRS Form 990, return, or other document, the date that the IRS received the IRS document, and that you are a subject of the IRS's investigation.

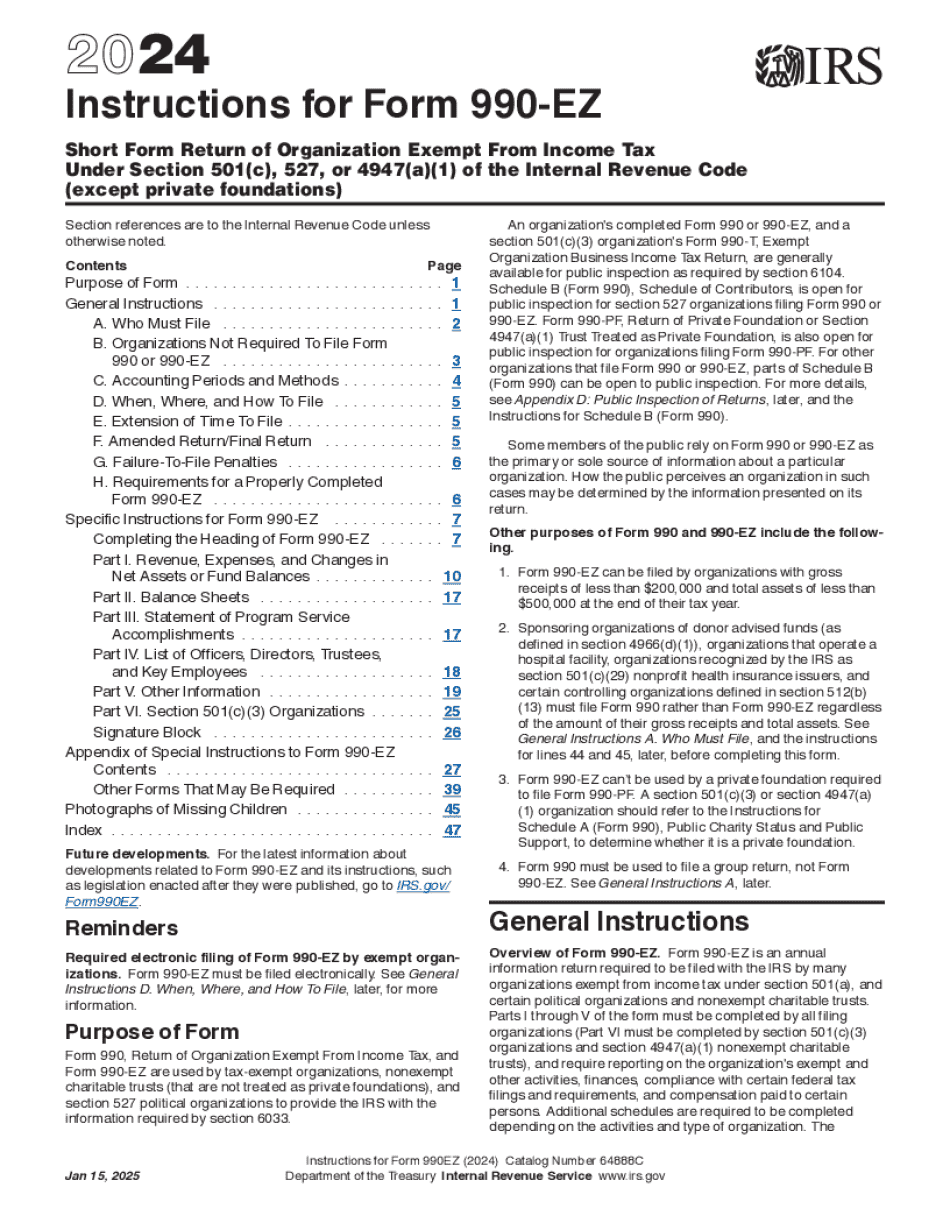

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Beaumont Texas Form Instructions 990-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a Beaumont Texas Form Instructions 990-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Beaumont Texas Form Instructions 990-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Beaumont Texas Form Instructions 990-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.