Award-winning PDF software

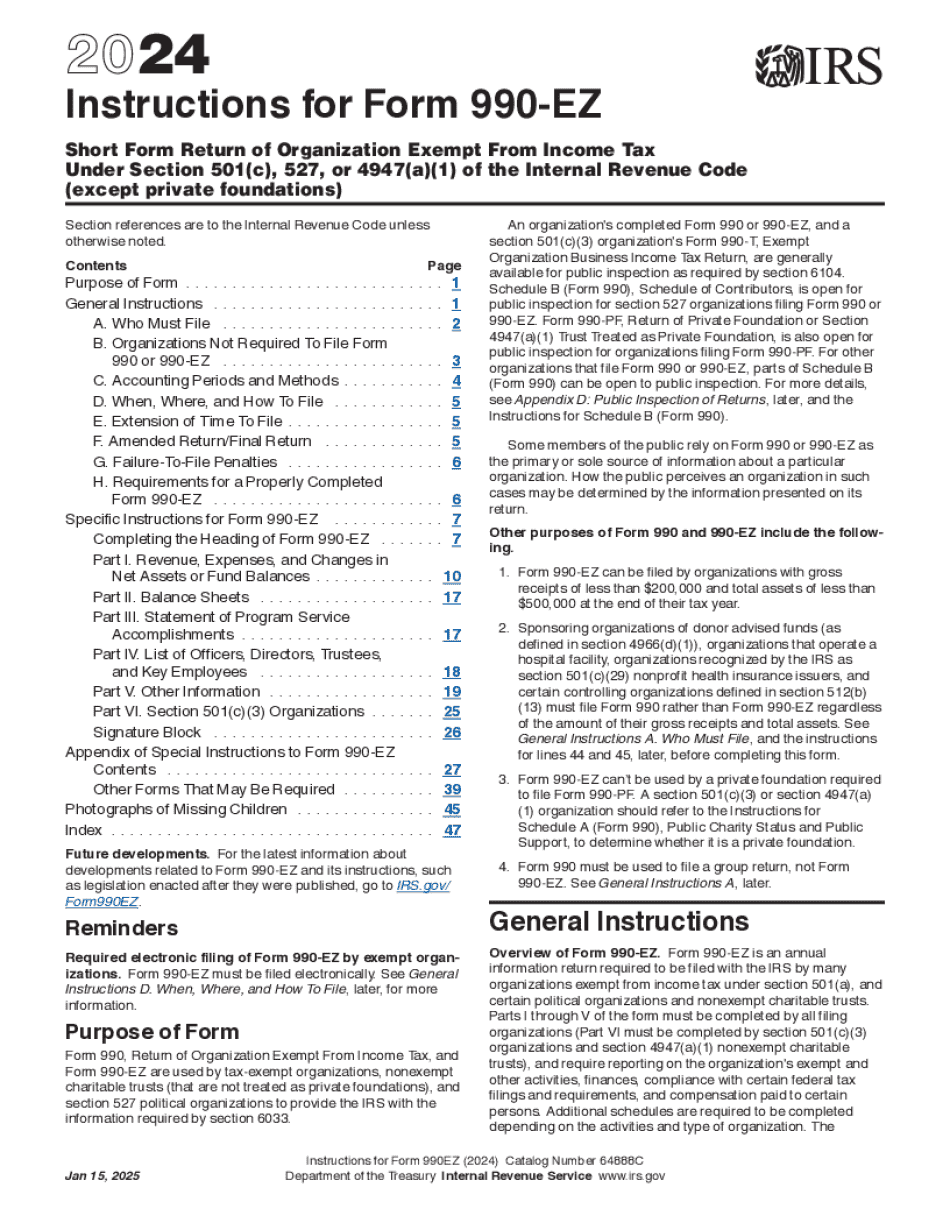

OK online Form Instructions 990-EZ: What You Should Know

Click Sign in to access. 2017 Oklahoma Form 511 Online Filing System The 2025 Form 511 Oklahoma resident individual income tax return is now filed by using the U.S. Electronic Tax Payment System (ETAS), a secure, nationwide tax payment systems available on the State of Oklahoma website. As of Sept. 24, 2025 the Oklahoma Form 511 Online Filing System is now available on the State of Oklahoma State website: . In order to use this system you must have an Oklahoma address. Click Sign in and select “E-File Oklahoma” to access the 2025 tax return. Form 511 is also available on our “Filing Information” page. Online Nonprofit Income Tax Return Tips Online Nonprofit Income Tax Return Tips The tax return processing time and estimated payment deadlines differ considerably for different types of taxes and for different types of non-profits. These vary depending on several factors including time of year, the type of organization and the type of taxes being filed (FICA, FTA, STATE, W-2 etc.). There are numerous factors contributing to this time difference, including the business structure of the non-profit (for example, sole proprietorship versus partnership), the size and scope of the organization in relation to its tax needs and its resources, the number of returns a specific organization files, the complexity of the tax issue and the complexity of the state and local tax codes. This information is provided for informational purposes only and should not be construed as legal advice. Please have a discussion with a tax professional before implementing any change in your organization's filing requirements. IRS Publication 527 — Filing Your Returns Online for Small and Mid-Sized Businesses (PDF File) The IRS published changes to the Small Business and Self-Employed Tax Guide to help nonprofit organizations that have fewer than 500 employees file their online returns and retain flexibility in determining whether they need to file on paper. Changes to Publication 527 include: (1) new options for filing your return online when you do not want to file it on paper; and, (2) an addition to Publication 527-G, Return of Business or Professional Exempt Organization, Exempt Organization Exempt From Income Tax, to outline how to prepare your return from your tax return summary and e-file (or provide paper e-filed copies to) a recipient outside the United States.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete OK online Form Instructions 990-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a OK online Form Instructions 990-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your OK online Form Instructions 990-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your OK online Form Instructions 990-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.