Award-winning PDF software

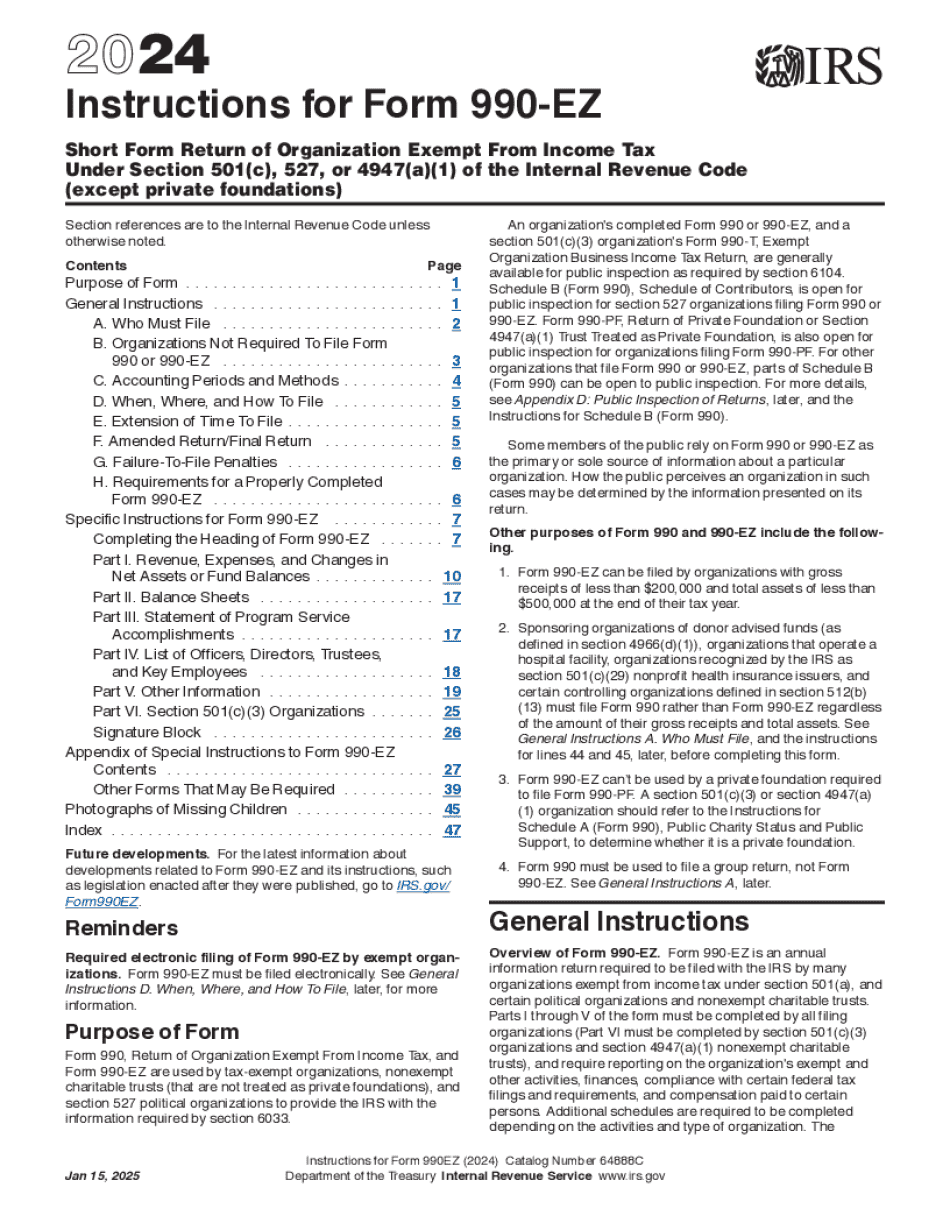

Printable Form Instructions 990-EZ New Hampshire: What You Should Know

E-File/Paperwork Apr 14, 2025 — Form 990 (Forms 990-EZ and 990PF) is required to be filed every two years by tax-exempt organizations. Form 990 Filing Requirements Apr 10, 2025 — Form 990, Nonprofit Annual Financial Report — New Hampshire Form 990 can be prepared by completing and filing Form 990, Nonprofit Annual Financial Report — New Hampshire and sending it to the Tax Collector's Office. For more information, see the information on the Forms 990 and 990PF. Form 686(f)(1)(vi) (Forms 990, 990EZ, and 990PF) Form 990 Nonprofit Financial Report Forms filed on or after May 15, 2018, are reported by the time that they are received by the IRS. Please allow time to mail Form 990, Nonprofit Annual Financial Report — New Hampshire to the IRS. Form 686(f)(1)(vi) requires copies of Form 990 and 990EZ. Tax Notice 2018-02, Nonprofit Tax Exempt Organization Annual Report The form (990 & 990PF) is a report of an activity that qualifies for tax-exempt status. These form may help you find information that helps you determine if an organization qualifies for tax-exempt status. Forms 990 (Forms 990PF and Form 990EZ) are reports of activity that qualifies as an exception to tax-exempt classification (such as activities that require no direct support to maintain the organization's exempt status of tax-exempt). These form may help you figure out if an organization qualifies for tax-exemption status. Please note that it can cost you about 4 to file each form. The forms may also be mailed to the following address. Office of the Revenue Administrator New Hampshire Revenue Resources 11 Main Street Suite 300 Conway, NH 03 For more information on non-exempt organizational tax return requirements, contact or call.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form Instructions 990-EZ New Hampshire, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form Instructions 990-EZ New Hampshire?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form Instructions 990-EZ New Hampshire aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form Instructions 990-EZ New Hampshire from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.