Award-winning PDF software

VA online Form Instructions 990-EZ: What You Should Know

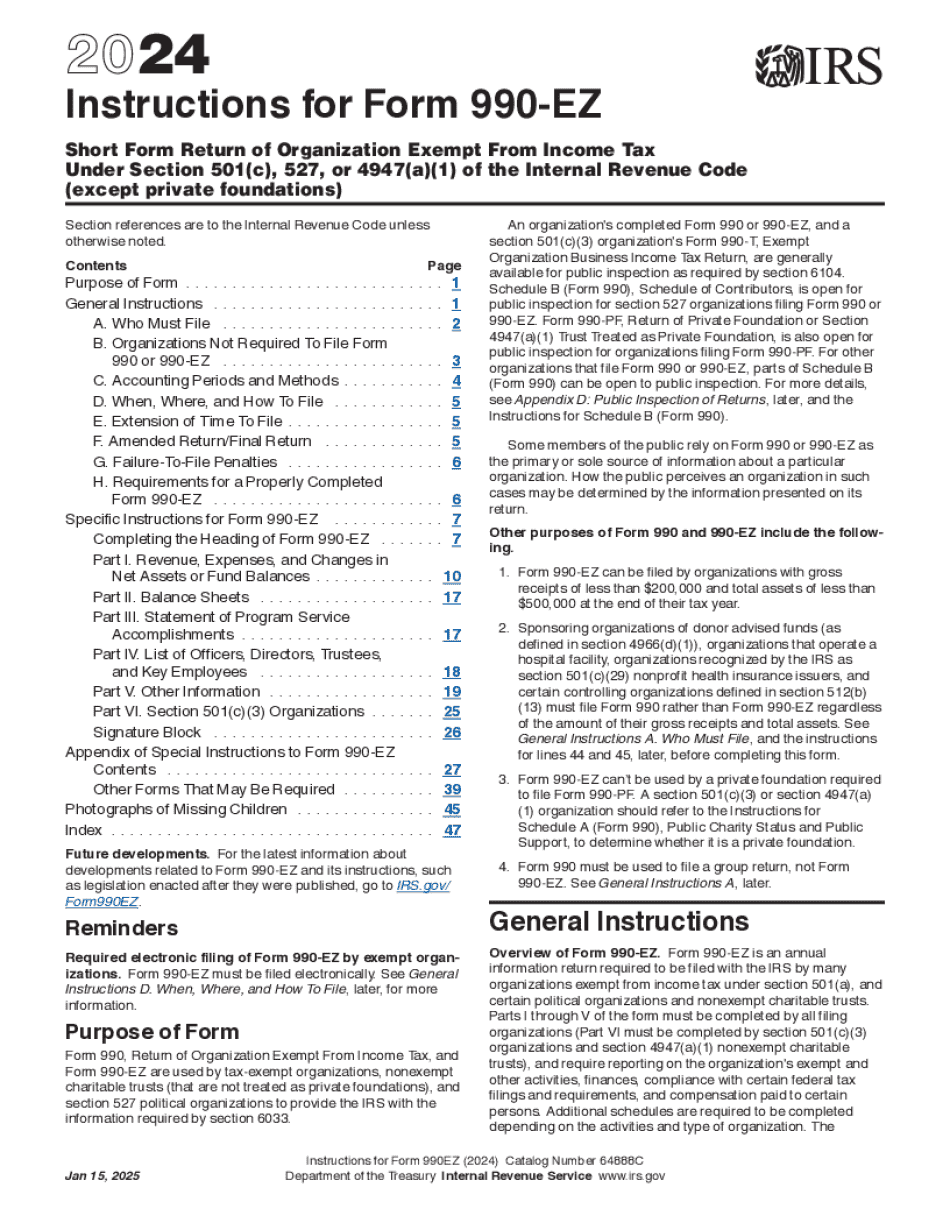

IRS filing) to be filed annually with the Virginia Department of Revenue Virginia Tax is the state tax agency responsible for the Virginia State income tax and provides nonprofit tax services and related information to local governments, businesses, universities, and the public. Virginia Tax also offers public assistance to lower- and moderate-income individuals and families. If it is uncertain whether your organization is required to file with the Commonwealth, check with your state-licensed financial institution. For your organization to receive state income tax assistance or services, it must be exempt or tax-exempt. Generally, “exempt” means that the organization is exempt from receiving state income tax. Exemptions are not always easy to see, or easy to claim. Form 990-EZ: 2025 Update The form was filed with the IRS on May 6, 2018. Virginia Form 990 Filing Guide 2025 for Nonprofits — 2025 Edition — Effective January 1st, 2025 (PDF) (Note: There are some differences between the 2025 and 2025 editions of this guide: the 2025 edition has an updated section with 2025 forms), is used from February 1 through April 15, 2018, to file federal and state non-profit tax forms if the IRS determines that they still apply to your group. The form, Form 990-EZ, is also a good time to check to see if you are required to file Form 990 with your state of Virginia. It is important with non-profits and charities to get your federal tax return for the preceding year filed at the end of March. It is then helpful to get an extension of time to file until the IRS accepts your return. In addition, it is generally helpful to get a separate return for reporting your work for charities or non-profit organizations. If you are required to file any form with Virginia at the time of your organization's incorporation, you will receive a letter from Virginia Tax asking you to fill out and return an Annual Statement as part of your incorporation documents. Virginia Tax does not require the annual filing of any form unless you have changed your organization's name, have entered into a contract with anyone having more power than you, or have been formed as a corporation. Virginia Tax does not give you any extra time to file with your group. If you choose to file anyway, send your filed Form 990 to VA Tax. Virginia Tax does not charge additional fees for this service.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete VA online Form Instructions 990-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a VA online Form Instructions 990-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your VA online Form Instructions 990-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your VA online Form Instructions 990-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.