Award-winning PDF software

How to prepare Form Instructions 990-EZ

About Form Instructions 990-EZ

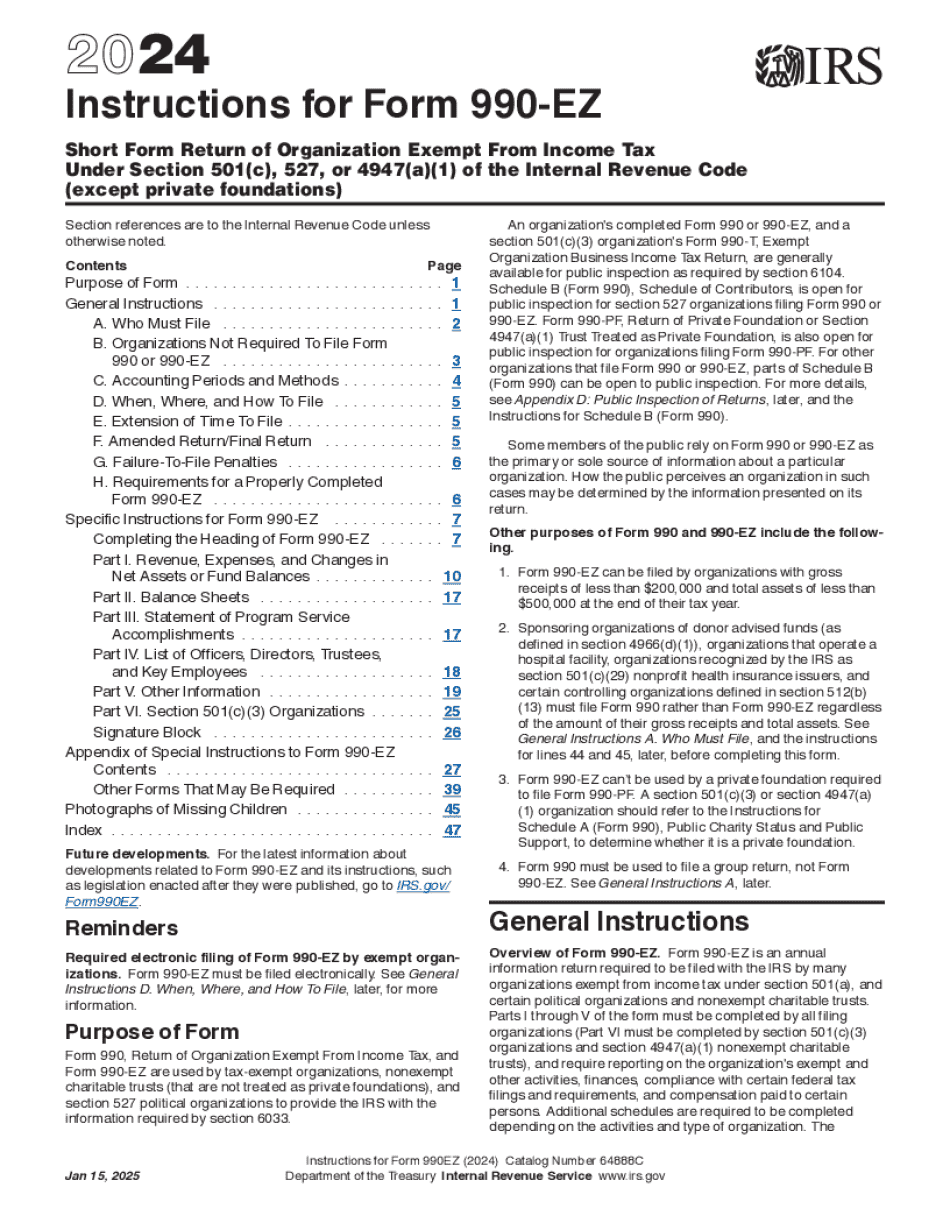

Form 990-EZ is a tax form used by certain tax-exempt organizations to report their financial information to the Internal Revenue Service (IRS) in the United States. The Form 990-EZ is a simplified version of Form 990, which is the primary tax return form for tax-exempt organizations. It is designed for organizations with annual gross receipts below a certain threshold, currently set at $200,000 or total assets below $500,000. The form requires organizations to provide information about their income, expenses, assets, liabilities, programs, and governance. It also includes questions about the organization's mission, activities, and compliance with various tax laws and requirements. Certain tax-exempt organizations, including charitable, religious, educational, scientific, and other nonprofit organizations, are required to file Form 990-EZ annually. This requirement helps to ensure transparency and accountability in the nonprofit sector, as the information provided in the form is available to the public. Overall, any tax-exempt organization meeting the eligibility criteria must complete and file Form 990-EZ, along with any necessary schedules and attachments, to fulfill their reporting obligations to the IRS. This form helps the IRS and the public determine an organization's financial health, governance, and compliance with tax laws.

What Is Irs 990 Ez Instructions Tax Form?

Online solutions assist you to arrange your document management and increase the productivity of your workflow. Look through the quick manual as a way to fill out Form Irs 990 Ez Instructions Tax Form?, avoid mistakes and furnish it in a timely manner:

How to complete a 2025 Irs 990 Ez Instructions?

-

On the website hosting the document, press Start Now and pass towards the editor.

-

Use the clues to fill out the suitable fields.

-

Include your personal information and contact data.

-

Make certain that you choose to enter true information and numbers in correct fields.

-

Carefully examine the data in the form so as grammar and spelling.

-

Refer to Help section if you have any questions or address our Support team.

-

Put an digital signature on the Form Irs 990 Ez Instructions Tax Form? printable while using the help of Sign Tool.

-

Once the form is completed, press Done.

-

Distribute the prepared via email or fax, print it out or save on your device.

PDF editor will allow you to make improvements to your Form Irs 990 Ez Instructions Tax Form? Fill Online from any internet linked gadget, personalize it in accordance with your requirements, sign it electronically and distribute in several ways.